“Short-Term Debt Frenzy” on Auction Block Exposes U.S. Fiscal Race Against Time

Relentless Debt Auctions

Fresh U.S. Treasury data reveals an unprecedented auction blitz: $724 billion in debt sold across four consecutive days this week. The breakdown shows America’s debt desperation:

- $505 billion in short-term debt (T-bills)

- $219 billion in long-term debt

Long-term bonds face collapsing demand—recent 10-year and 30-year auctions saw catastrophic failures, with soaring yields inflating repayment costs.

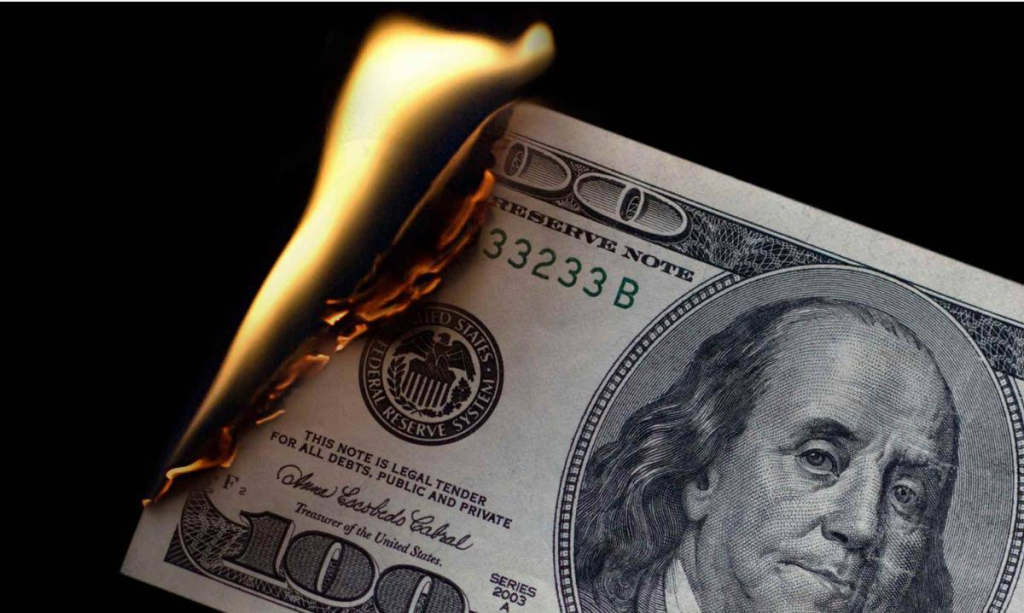

Cash Crunch Accelerates

The core crisis? Washington is burning cash faster than it can collect it. Without this week’s massive debt sale, the Treasury’s account would dry up instantly. On June 12, the Treasury General Account (TGA) plunged to a perilous $26 billion low, only rescued by tax receipts and $20 billion from new tariffs.

$38 Trillion Debt Looms

To hit its September TGA target of $850 billion, the Treasury must sell another $350 billion in debt. By Q3 2024, U.S. debt will likely smash through $38 trillion.

Debt Trap by the Numbers

- Debt-to-GDP: 123% (vs. 92% when S&P downgraded U.S. credit in 2011)

- Annual interest: $1.1 trillion—$3 billion due daily

- Tariff lifeline: Projected to yield $300 billion/year (per Treasury Secretary Besant)

Tariffs: Killing the Dollar They Save

While tariffs temporarily plug budget holes, they accelerate dollar decay:

- 🇨🇳 China has dumped U.S. debt for years, unlikely to reverse course amid trade wars

- 🇸🇦 Saudi Arabia now conducts 25% of oil trades in yuan

- 🇻🇳 Vietnam’s factories demand upfront payment from Apple—rejecting dollar checks

- Global dollar reserves crash to 58%—a 30-year low

The Triffin Paradox Exposed

Trump’s tariffs have ripped open the dollar’s fatal flaw: demanding global use of dollars (requiring trade deficits) while forcing nations to fund U.S. debt.

Fed in Crosshairs

The Fed faces impossible choices:

- Under pressure to monetize $7.5 trillion of debt

- Long-term yields spike to 5.2%

- Rate cuts stalled by inflation fears

Global Run to Gold

As faith in dollar debt evaporates:

- Gold surges past $3,500/oz

- 🇨🇳 China’s gold reserves hit 2,211 tonnes

- 🇷🇺 Russia swaps gold for Iranian drones—weaponizing bullion

The Verdict

America’s debt machine is now on borrowed time. With every auction, the countdown to fiscal reckoning ticks louder.