Driven by a slight rebound in consumer spending and a significant slowdown in imports at the beginning of the year, US economic activity showed a notable rebound in the second quarter.

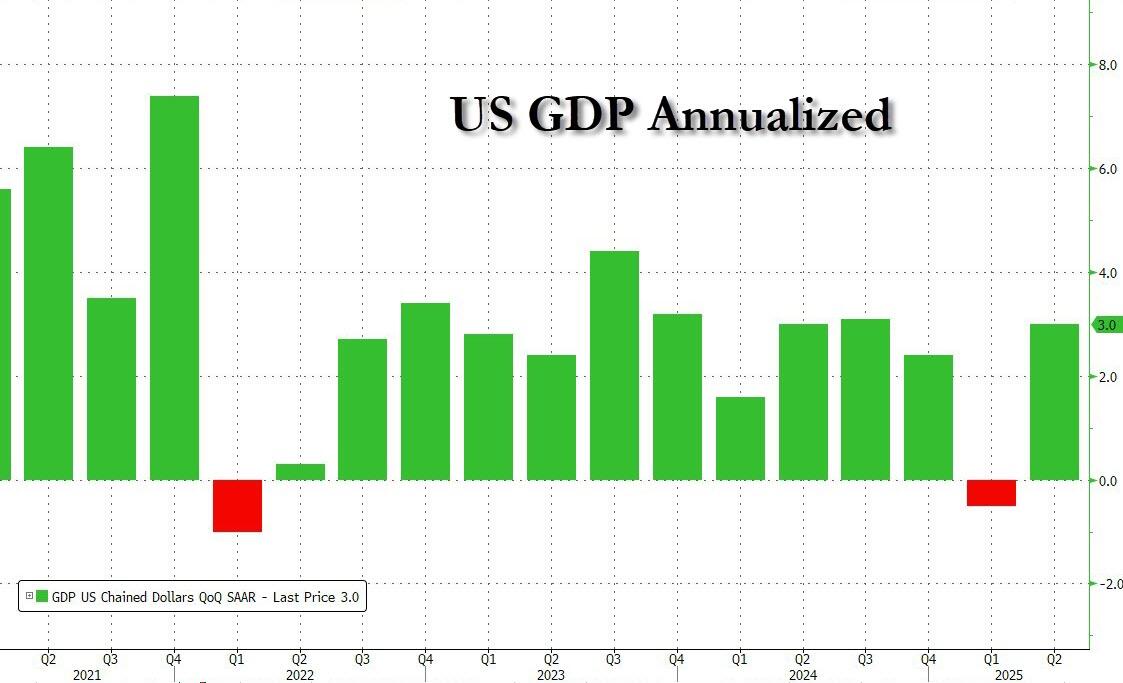

Initial data released by the US Bureau of Economic Analysis (BEA) on Wednesday showed that GDP growth, adjusted for inflation, was at a rate of 3% annually, not only completely reversing the contraction in the first quarter (-0.5%), but also significantly exceeding market expectations of 2.6%.

The data released simultaneously showed that the initial annualized quarterly year-on-year growth rate of the U.S. core Personal Consumption Expenditures (PCE) price index was 2.5%, a significant drop from the previous 3.5%, but still higher than the expected 2.3%. The rebound in inflation will make the Federal Reserve more cautious in its interest rate policy.

A significant decline in imports drove the reversal of the downturn in Q2 GDP

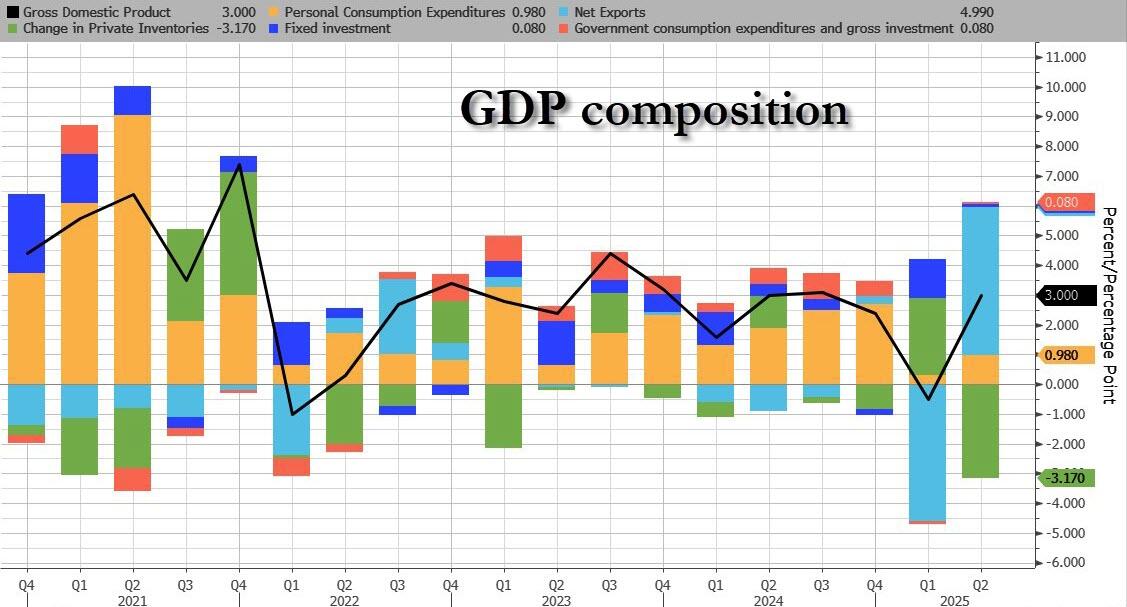

The data revealed that U.S. inflation-adjusted real GDP surged in the second quarter, primarily driven by two forces: first, a substantial decline in imports, and second, resilient consumer spending.

According to data released by the U.S. Bureau of Economic Analysis (BEA), the contraction of U.S. GDP recorded at -0.5% in the first quarter was primarily due to a surge in imports, which are classified as “deductibles” in GDP calculations. In other words, that economic downturn was not caused by weak domestic demand, but rather by a statistical decline resulting from companies “rushing to import goods” against a backdrop of stable consumer spending.

As the second quarter arrived, imports declined, causing net exports to boost GDP by a remarkable 5 percentage points, a historically rare occurrence.

Meanwhile, consumer spending grew by 1.4%, slightly below the expected 1.5%, marking the mildest growth in two consecutive quarters. Notably, private domestic final sales, which better reflects domestic demand conditions, only rose by 1.2%, the slowest pace since the end of 2022, indicating a marginal weakening in the underlying demand momentum.

Consumption remains a key pillar, with auto and service spending showing slight recovery

Although overall consumer spending growth has slowed, structurally, durable goods consumption (particularly automobiles) has rebounded, and service demand has also shown improvement. Multiple companies, including Chipotle and United Airlines, mentioned in their earnings reports that resurging consumer confidence is driving a recovery in spending.

However, the background of the rebound in spending is also related to the stabilization of the political environment. The Trump administration recently reached agreements with key trade partners such as the EU and Japan, partially alleviating market concerns about the expansion of tariffs. Businesses generally report that the perception of trade policy uncertainty is declining, which helps investment and consumption to rebound.

United Airlines CEO Scott Kirby noted in a July 17 phone conference, “Clearer policy expectations allow the market and businesses to make plans within a smaller range of fluctuations, and this certainty is bringing a substantive inflection point in demand.”

Corporate investment and exports have both declined, real estate is weakening, and inventory is dragging down the growth rate.

However, the economic recovery is not without concerns. The decline in corporate investment and exports reflects that under the environment of high interest rates and slowing external demand, some growth drivers are weakening.

The growth rate of non-residential fixed investment in the second quarter fell to 1.9%, far below the peak in the first quarter. Although Trump signed a budget bill this month to make the 2017 tax reform permanent and retain incentives for business investment, corporate spending enthusiasm has clearly cooled.

Real estate remains one of the biggest drags on the economy. Residential investment fell by 4.6% year-on-year, its worst performance since 2022. In an environment of high interest rates, both homebuyers and developers are waiting for cheaper financing conditions, while the spring sales season set the worst record in 13 years.

Meanwhile, changes in inventory are dragging down GDP by 3.17 percentage points, the largest since 2020. This change reflects the accumulation of inventory due to businesses’ rush to buy at the beginning of the year, which was gradually cleared in the second quarter.

Behind the data, is it recovery or illusion?

On the surface, the strong economic growth in the U.S. second quarter is enough to shatter the pessimistic expectations of “falling into a recession”; but delving deeper into the data reveals that the triple hidden concerns of slowing domestic demand, rebounding inflation, and weak investment have not been eliminated.

As one market analyst said, “This is a ‘strong’ set of data, but it could also be an illusion under the trade noise.”

Key indicators such as consumer spending, inflation, and non-farm employment will also be released next, further revealing the underlying momentum of the economy.

For the Federal Reserve, while stronger-than-expected GDP data may mean a higher probability of a “soft landing,” it also weakens the rationale for rapid rate cuts this year. Analysts generally expect the Federal Reserve to keep interest rates unchanged this week, waiting for more data to validate the economic trend.

This article is from Wall Street Journal, welcome to download the APP to view more.