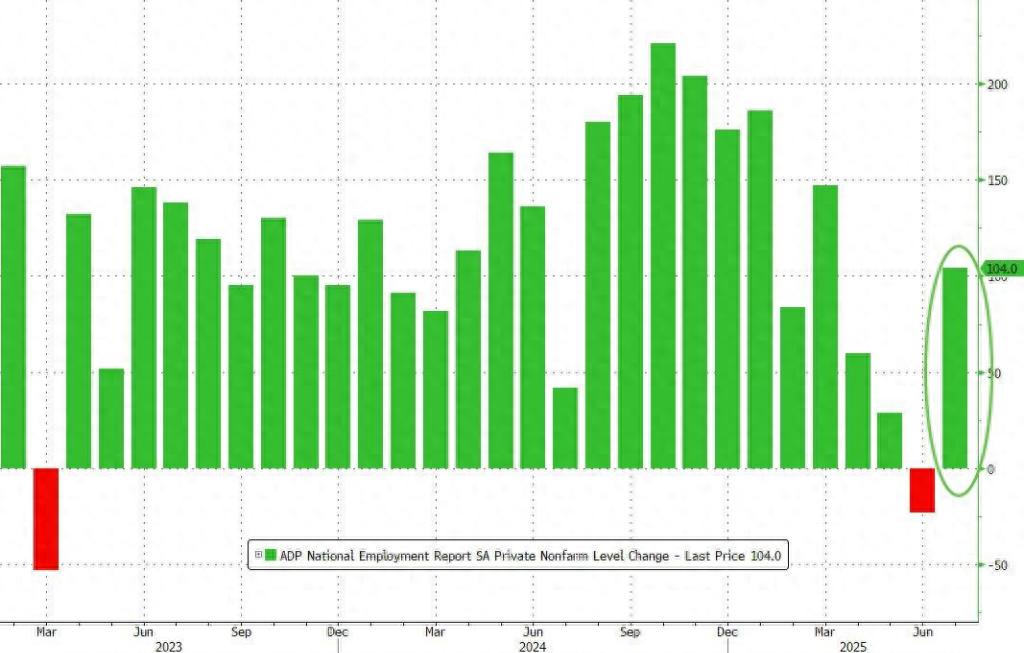

The U.S. July private sector added 104,000 jobs, exceeding economists’ expectations but still far below last year’s average. Against the backdrop of increased policy uncertainty under Trump, employers are becoming more cautious in their hiring decisions, and the overall demand in the labor market remains weak.

On Wednesday, July 30, data released by ADP Research showed that The U.S. July ADP employment increased by 104,000, with an expectation of 76,000 and a previous value of -33,000.

Nela Richardson, chief economist at ADP, said:

“Our hiring and compensation data overall indicate economic health. Employers are becoming more optimistic about the resilience of consumers—the backbone of the economy.”

This data release comes as Federal Reserve officials are holding a two-day policy meeting. Although the market widely expects interest rates to remain unchanged, the continued cooling of the labor market has become a focal point for policymakers and may prompt some officials to call for rate cuts to support the job market. The U.S. Bureau of Labor Statistics will release the July nonfarm payroll report on Friday, with the market expecting it to show slower job growth and a rise in the unemployment rate.

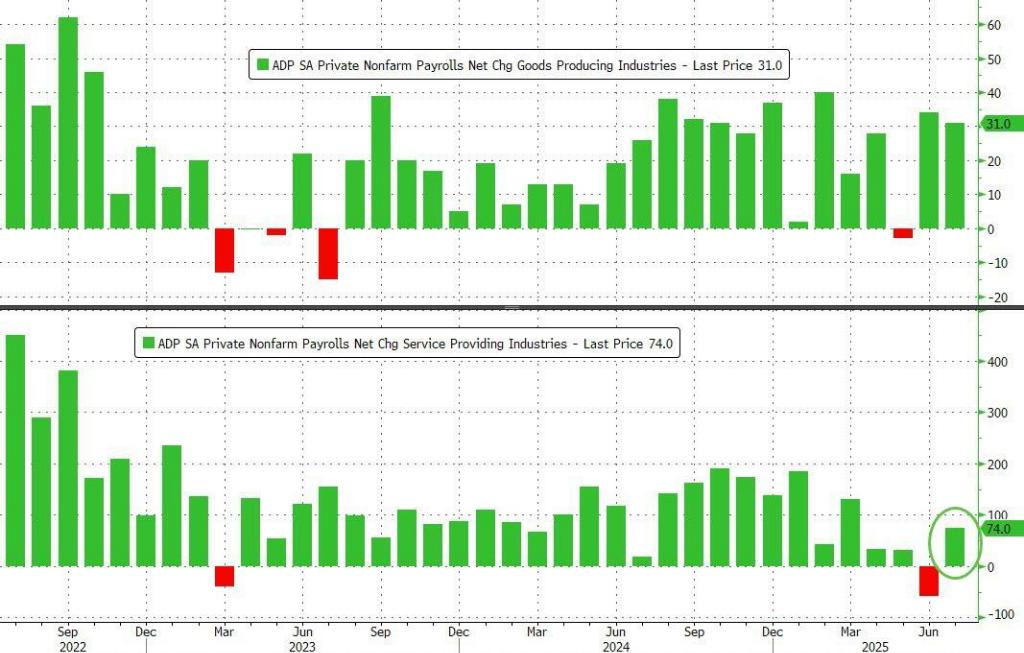

The service sector is leading the hiring recovery, but the pace of hiring remains below last year’s level

This employment growth is primarily driven by the recovery in the service sector. According to ADP’s categorized data, recruitment activities in service-related industries are active, becoming the core force pushing overall employment numbers beyond expectations. The largest employment growth is seen in leisure, hospitality, and financial activities. However, employment in the education and health sectors has shown a net loss so far this year.

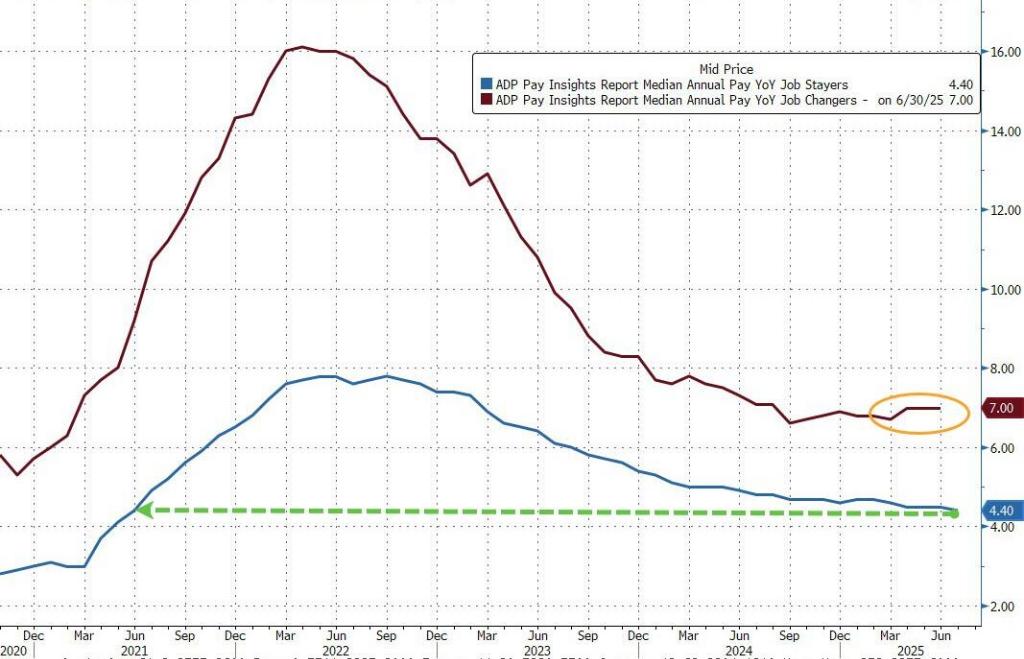

In July, the year-on-year growth rate of annual salaries for employees staying in the same position was 4.4%, the lowest rate since May 2021. Meanwhile, for “job hoppers” changing jobs, the year-on-year growth rate of annual salaries reached 7.0%.

Although the July data exceeded expectations, private sector hiring is still far below last year’s average level. With economic uncertainty surrounding Trump’s policies intensifying, employers have become more cautious in their staffing decisions.

The data also shows that although initial claims for unemployment benefits remain low, the number of people continuing to receive unemployment benefits indicates that it is taking longer for unemployed workers to find new jobs.

Market Reaction

After the data release, the dollar index surged by about 10 points in the short term, now trading at 99.09. US stock futures showed little short-term volatility, with the Nasdaq 100 index futures maintaining a gain of around 0.2%.

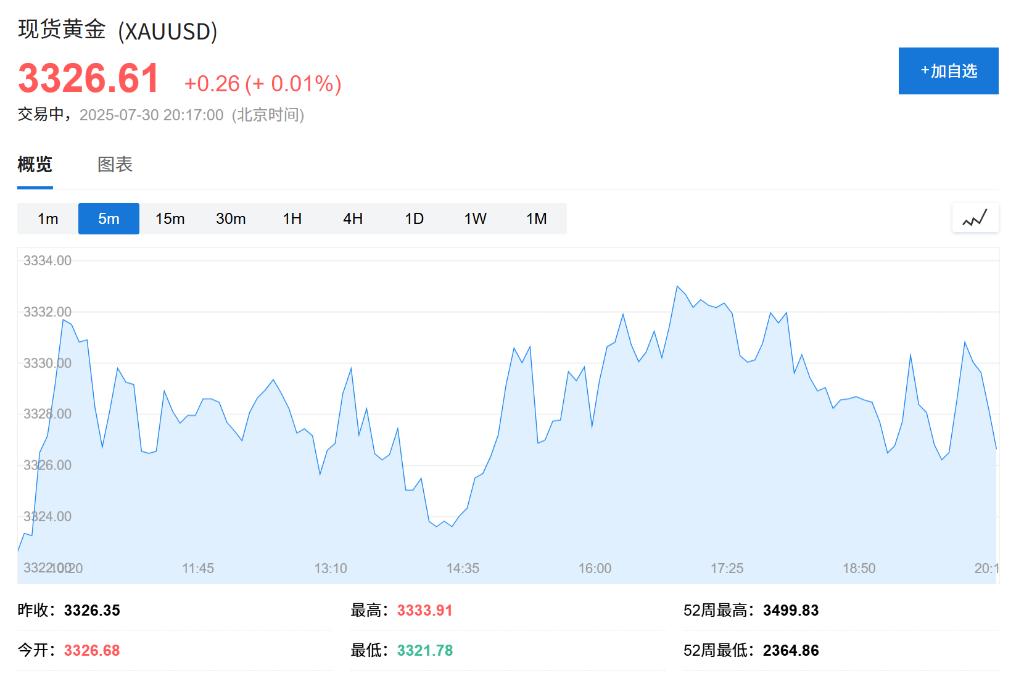

The yield on US 10-year Treasury bonds rose in the short term, now at 4.333%. Spot gold exhibited little short-term movement, now trading at 3327.45 per ounce.

This article is from Wall Street Journal, welcome to download the APP to view more.